Real Estate Consultancy in Turkey

Navigating the Turkish real estate market can be a complex endeavor, but with Real Estate Consultancy in Turkey provided by Homes Gravity, it becomes a

PROPERTY SEARCH

LATEST LISTING

Connecting with Homes Gravity real estate consultants

In the dynamic world of real estate investment, particularly in a vibrant market like Turkey, maximizing asset value recovery is a key objective for investors. With Turkey’s unique economic conditions playing a significant role, Homes Gravity offers strategic insights into how investors can enhance the value recovery of their real estate assets in this emerging market.

Turkey’s economy has been characterized by its resilience and potential for growth, despite facing challenges such as inflation and currency fluctuations. As of the latest reports, while there have been instances of economic volatility, sectors like real estate continue to show promising signs of stability and growth.

These economic conditions directly impact real estate investments. Fluctuations in the Turkish Lira can affect property prices and investment returns, making it crucial for investors to employ strategic approaches to protect and enhance their asset value.

Diversification within the Turkish real estate market can mitigate risks associated with economic fluctuations. Investing in a mix of residential, commercial, and developmental properties across different regions can balance out potential losses and gains.

Investing in properties located in high-demand areas such as Istanbul, Antalya, and Izmir can lead to better value retention and recovery. These areas typically experience steady demand, which can safeguard against significant market downturns.

Properties with potential for rental income can provide a steady cash flow, which is a vital component of asset value recovery. In tourist-frequented areas or cities with large student populations, rental properties can yield consistent returns.

Investing in timely renovations and upgrades can significantly enhance the value of a real estate asset. This is particularly true in older properties, where modern renovations can increase both aesthetic appeal and market value.

Staying informed about the latest real estate market trends in Turkey, including pricing, demand fluctuations, and buyer preferences, is crucial. This knowledge can guide strategic buying and selling decisions, maximizing asset recovery.

High inflation rates can affect property values and investment returns. In Turkey, where inflation has been a concern, understanding its impact on property prices and rental income is crucial for asset value maximization.

For international investors, currency fluctuations between their home currency and the Turkish Lira can impact the value of their investments. Strategies such as hedging against currency risks can be beneficial.

Government policies, such as tax incentives, urban renewal projects, and foreign investment laws, can influence the real estate market in Turkey. Keeping abreast of these policies can help in making informed investment decisions.

Maximizing asset value recovery in Turkish real estate investments requires a strategic approach, informed by a deep understanding of the market and economic conditions. By diversifying investments, focusing on high-demand locations, and staying informed about market and economic trends, investors can enhance the value recovery of their real estate assets. Homes Gravity, with its expertise and knowledge of the Turkish real estate market, is ideally positioned to guide investors through this complex landscape, helping them achieve their investment objectives and maximize asset value recovery.

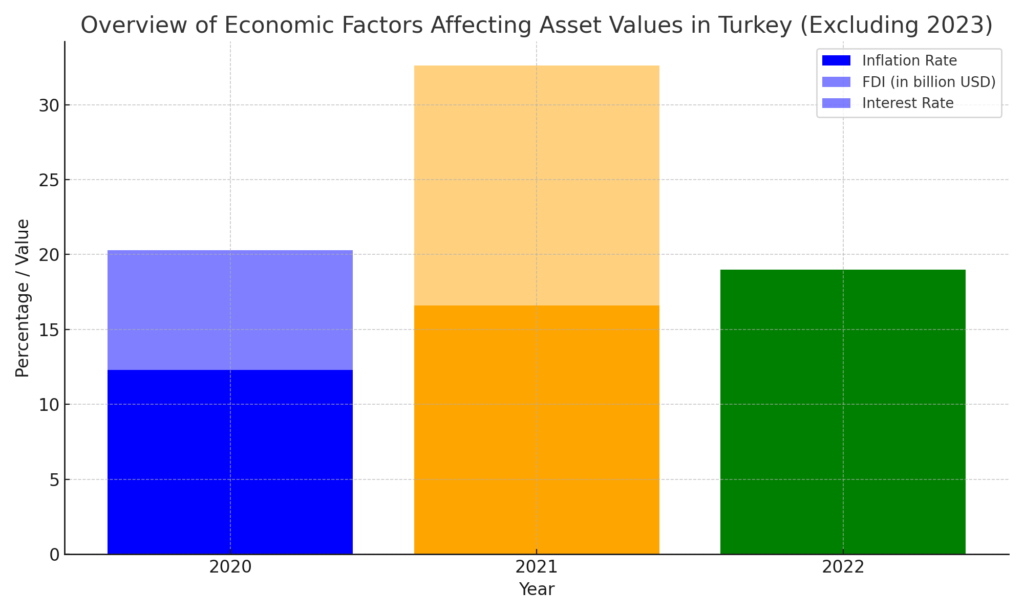

The asset values in Turkey, especially in the real estate sector, have been significantly influenced by various economic factors from 2020 to 2023. At Homes Gravity, we understand the importance of data-driven analysis for our clients to make informed investment decisions. This article delves into the key economic factors that have impacted asset values in Turkey, supported by relevant data over the last four years.

Several macroeconomic and microeconomic factors have played crucial roles in shaping asset values in Turkey, including inflation rates, interest rates, foreign direct investment flows, and geopolitical events. Each of these factors has a direct or indirect impact on asset valuation, particularly in real estate.

2020: The Onset of the COVID-19 Pandemic

2021: Recovery and Economic Reforms

2022: Fluctuating Economic Conditions

2023: Stabilization Efforts and Market Response

The data from 2020 to 2023 highlight the complex interplay of various economic factors on asset values in Turkey. Inflation, interest rates, foreign investment, and currency stability have all played significant roles. For investors, particularly in real estate, understanding these dynamics is crucial for making informed decisions.

At Homes Gravity, we provide our clients with not just data but also the context and expertise to interpret these figures correctly. Whether you are looking at short-term investments or long-term asset growth, a nuanced understanding of these economic factors is key to successful asset management in Turkey’s vibrant market.

Join the review, rate and share your views

Share with your friends and followers

Navigating the Turkish real estate market can be a complex endeavor, but with Real Estate Consultancy in Turkey provided by Homes Gravity, it becomes a

Discover the ins and outs of real estate in Turkey, from market trends to investment. Find your dream property with Homes Gravity as your trusted

The real estate market is known for its cyclical nature, with periods of growth and stability followed by periods of correction. If you’re considering investing

Digital Currencies or Real Estate Investment in Turkey – Discover the advantages of real estate investment over digital currencies, including tangible assets

Discover the 4 Benefits of Buying a Newly Built Home in Turkey – From modern amenities to financial incentives, find out why investing in Turkey’s

Buying property in Turkey, like other investments, presents threats and opportunities that can be identified and Neutralized with the assistance of HomesGravity

Follow for updates and more

Compare listings

ComparePlease enter your username or email address. You will receive a link to create a new password via email.