Why House Price Increased in Istanbul 2023?

Why House Price Increased in Istanbul 2023 Discover the Reasons Behind Rising House Prices in Istanbul Understanding the Surge in House Prices in Istanbul

PROPERTY SEARCH

LATEST LISTING

Connecting with Homes Gravity real estate consultants

Over the past decade, Turkey’s real estate market has experienced significant growth, with property prices seeing a consistent upward trajectory. In this article, Homes Gravity provides a detailed analysis of property price trends in Turkey from 2013 to the present, offering insights into the opportunities and challenges for real estate investors.

From 2013 to 2017, Turkey’s real estate market witnessed steady growth. The average property prices across major cities like Istanbul, Ankara, and Izmir increased annually by approximately 10-15%. This period was marked by political stability and economic growth, contributing to a surge in both domestic and foreign real estate investment.

Between 2018 and 2021, property prices in Turkey experienced an accelerated growth, with annual increases reaching up to 20-25% in some areas. This surge was fueled by several factors:

In 2022, the trend of climbing property prices continued, albeit with regional variations. Istanbul, for instance, saw property prices rise by around 30% compared to the previous year, while other cities also reported significant increases.

The Turkish Lira’s fluctuation has had a significant impact on property prices, particularly affecting foreign investment. Inflation rates and interest rate policies also play a crucial role in shaping the real estate market.

The increasing demand for properties, both from domestic buyers and international investors, set against a backdrop of limited supply in high-demand areas, has been a key driver of price increases.

Policies aimed at attracting foreign investment, such as the reduction of taxes and the citizenship-by-investment program, have significantly boosted the market.

Despite short-term fluctuations, the long-term growth prospects of the Turkish real estate market remain strong. The continuous development of infrastructure and urban areas, combined with Turkey’s strategic geographical position, bodes well for future property value appreciation.

Investment hotspots like Istanbul, Antalya, and the Aegean Coast continue to offer lucrative opportunities for investors. These areas not only promise capital appreciation but also rental income potential.

Secondary cities and suburban areas are emerging as new investment destinations, offering affordable entry points and significant growth potential.

The consistent rise in property prices in Turkey since 2013 highlights the strength and potential of the Turkish real estate market. For investors looking to capitalize on these trends, understanding the underlying market dynamics is crucial. Homes Gravity, with its extensive knowledge and experience, is ideally positioned to guide investors through this evolving landscape. By leveraging our insights and expertise, investors can make informed decisions and strategically position themselves to benefit from the promising prospects of the Turkish real estate market.

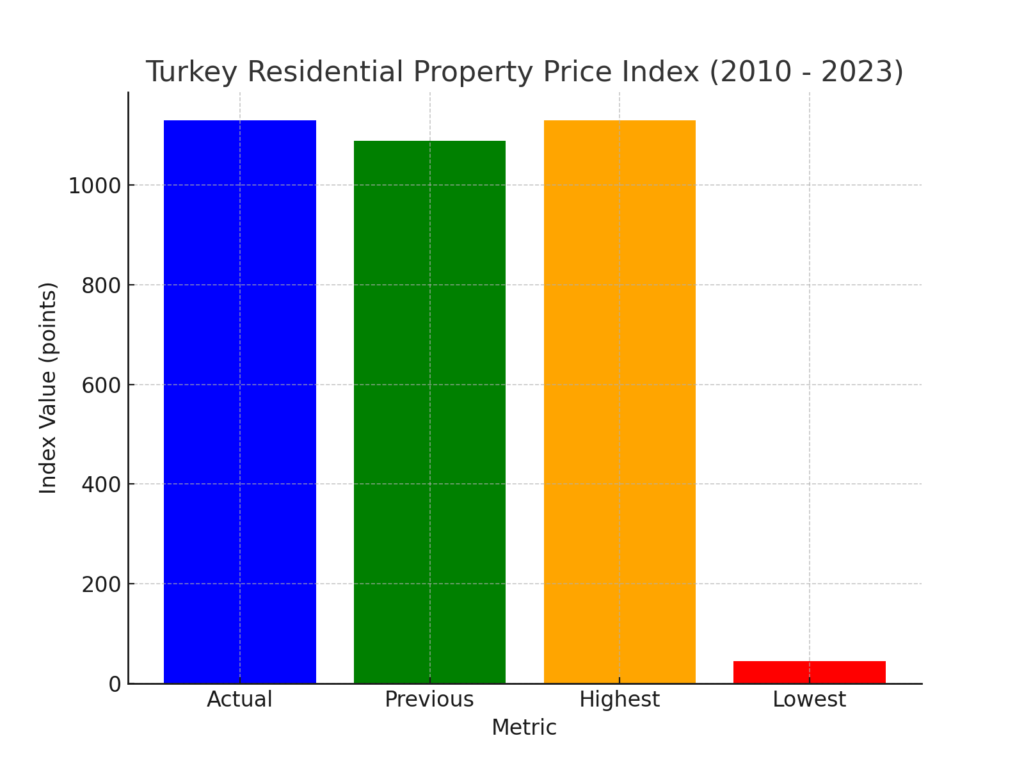

In the dynamic landscape of real estate, the Turkey Residential Property Price Index (TRPPI) serves as a crucial indicator for understanding the trends and changes in the property market. This article, presented by Homes Gravity, offers an in-depth analysis of the TRPPI, its significance, and what it implies for investors, homeowners, and the broader economy.

The TRPPI is a statistical measure that tracks changes in residential property prices across Turkey. Compiled and published by authoritative bodies like the Turkish Statistical Institute (TÜİK) or central financial institutions, this index provides valuable insights into the health and direction of the real estate market.

Examining TRPPI data from recent years reveals significant trends:

At Homes Gravity, we utilize the TRPPI, among other tools, to offer tailored advice to our clients:

The Turkey Residential Property Price Index is an essential barometer for anyone interested in the Turkish real estate market. Whether you are a potential homebuyer, an investor, or a market analyst, the TRPPI offers valuable insights into the evolving landscape of Turkey’s property market. Understanding these trends is crucial, and with Homes Gravity, clients can navigate this complex market with confidence and clarity, making informed decisions backed by comprehensive data and expert analysis.

Join the review, rate and share your views

Share with your friends and followers

Why House Price Increased in Istanbul 2023 Discover the Reasons Behind Rising House Prices in Istanbul Understanding the Surge in House Prices in Istanbul

In recent years Turkey has emerged as a promising destination for property investment attracting both local and international buyers One of the key trends observed

Discover the Real Estate Index Report 2023 for Turkey Insights on trends price movements rental opportunities foreign investment and more

Discover the Surging Property Prices Increased in Alanya Uncover the factors behind the remarkable increase in property values in this charming coastal town

Discover the Real Estate Renovation Cost in Turkey 2023 Get valuable insights and guidance for your renovation projects in Turkey including estimated costs

Investing in Turkey Property in 2023 An Opportunity for Growth and Stability Thriving economy competitive prices attractive citizenship programs

Follow for updates and more

Compare listings

ComparePlease enter your username or email address. You will receive a link to create a new password via email.